Ryan purchased 3 apples for 180. Choose the icon enter Adjust Cost - Item Entries and then choose the related link.

Rate Analysis For Providing And Fixing Wooden Door How To Use Rate Analysis For Providing And Fixing Wooden Door

However in reality this may equate to a lump sum price.

How to fix rate per unit of an item. When you create a unit of measure set you can specify which unit of measure appears by default when adding an item to a purchase form a sales form and a. Choose the OK button. In a unit rate contract the contractor offers a price for each material during the tender.

To make general changes in the direct unit cost. Examples of How to Find Unit Rate or Unit Price. So the price per unit of the product is 216.

The manufacturer decided to produce 25000 units in 2017. The failure rate of a system usually depends on time with the rate varying over the life cycle of the system. A rate is a ratio comparing quantities of different items.

If an item on the work order has a variable lead time the system determines the start date by using the lead time per unit to backschedule. Listing the unit rates per item can facilitate the calculation of possible modifications or variation orders and avoid risks. It is usually denoted by the Greek letter λ and is often used in reliability engineering.

A unit of measure set consists of a base unit and any number of related units. The cost per unit should decline as the number of units produced increases primarily because the total fixed costs will be spread over a larger number of units subject to the step costing issue noted above. In the Adjust Cost - Item Entries window specify which items to adjust costs for.

If you have a rate such as price per some number of items and the quantity in the denominator is not 1 you can calculate unit rate or price per unit by completing the division operation. Within these restrictions then the cost per unit calculation is. A unit rate is a rate with 1 in the denominator.

Following are some critical advantages of pricing a product. Demand is 10000 units per annum. AFC is the amount of fixed cost used per item produced.

To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit. Set up a fraction with the total cost as the numerator top number and the total number of items as the denominator bottom number. These are different from variable costs which are the costs that are only incurred with an additional unit produced.

If on the other hand we are going to use a sub-contractor to perform all of the activities we would use the unit rate from the subcontractor and only add items 13 14 and 15. Calculate the economic batch quantity EBQ for Item X. Setup cost is 2700 per batch.

Numerator divided by denominator. The formula to find the fixed cost per unit is simply the total fixed costs divided by the total number of units produced. Divide the total cost by the total number of items to reduce the.

It also represents your breakeven point or the minimum you must sell the item at. Work order due date October 15. For example an automobiles failure rate in its fifth year of service may be many times greater than its.

Price per Unit 1836 216. Divide your monthly fixed costs by the average per-unit sales price minus your variable cost per unit. The fixed cost per unit would be 12000010000 or 12unit.

Fixed costs are the costs that do not change when there are additional units produced. If you need to change the direct unit cost for several items you can use the Adjust Item CostsPrices batch job. As an example suppose that a company had fixed expenses of 120000 per year and produced 10000 widgets.

Failure rate is the frequency with which an engineered system or component fails expressed in failures per unit of time. In block rate tariff the energy consumption is divided into blocks and the price per unit is fixed in each blockThe price per unit in the first block is the highest and it is progressively reduced for the succeeding blocks of energyFor example the first 30 units may be charged at the rate of 60 paise per unit. The system uses this calculation.

The resulting figure is your break-even point or the number of units you must sell before you start earning a profit. Leadtime per unit order quantity Time basis code unit value Setup Total queue Work hours per day. Total fixed costs Total variable costs Total units produced.

To enter a new market various marketing techniques such as low-cost pricing or predatory pricing are concerned. Unit of measure sets are available only when Multiple UM Per Item is selected as the unit of measure mode. The rate of profit will remain the same.

Storage cost is 250 per unit for a year. The next 25 units at the rate of 55 paise per unit and the remaining additional units may be charged at the rate of 30 paise per unit. The selling expenses per unit will be reduced by 20.

It is estimated that the cost of raw materials will increase by 20 the labour cost will increase by 10 50 of the overhead charges are fixed and the other 50 are variable. Cost Per Unit Total Fixed Costs Total Variable Costs Total Units Produced The cost per unit means more than how much it costs to produce a single unit of your product. Annual production rate R 500 x 50 25000 units Annual demand rate 10000 units Cost per setup C o 2700 Cost of holding one item in inventory per year C h 250.

The subcontractor though would calculate the unit rate inclusive of all the items from 1 to 15. The unit price helps the company to adequately market its product. Evenly spread over 50 working weeks.

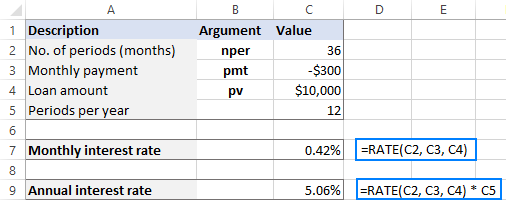

Using Rate Function In Excel To Calculate Interest Rate

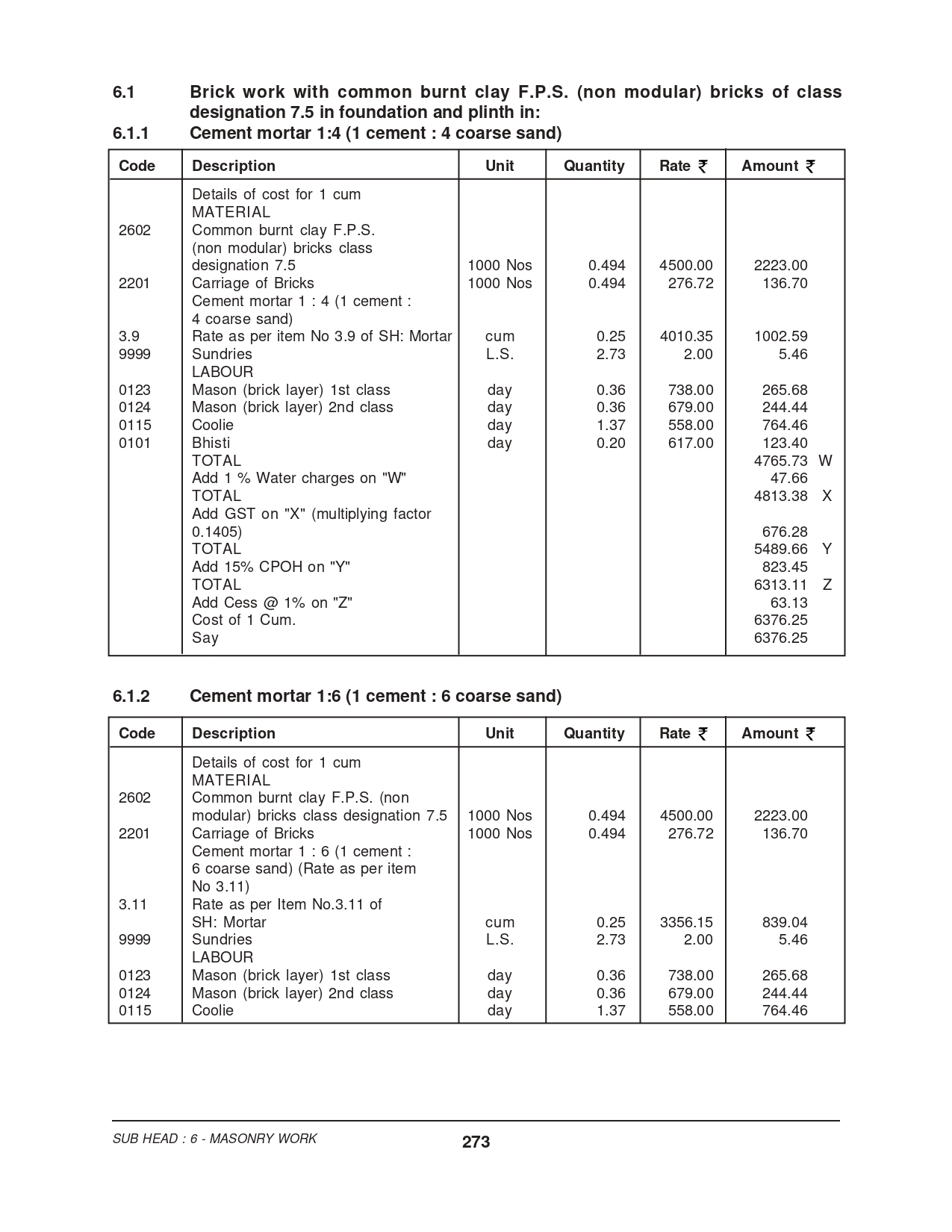

Rate Analysis For Pcc 1 4 8 M7 5 Calculate Quantity Cost Civil Sir

The Absorption Costing Method In Management Accounting Magnimetrics

What Is Rate Analysis Purpose Of Rate Analysis Cpwd Tutorials Tips

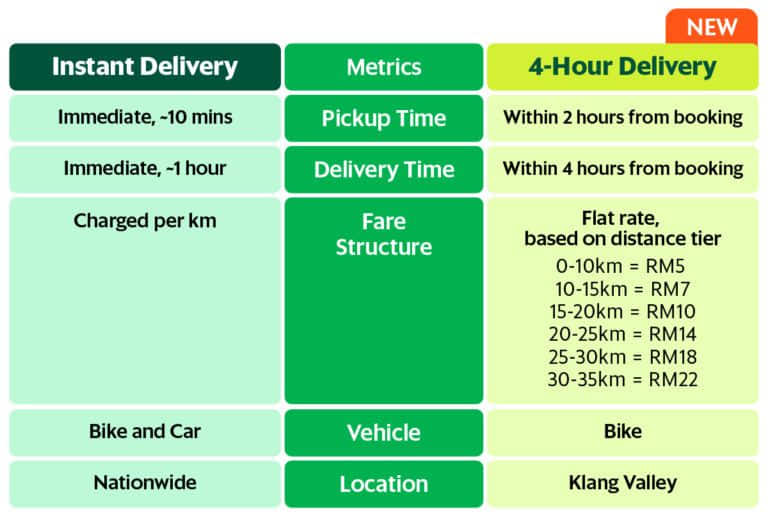

Grabexpress Parcel Courier Delivery Service Grab My

Manage Buying And Selling Prices Tally Erp 9

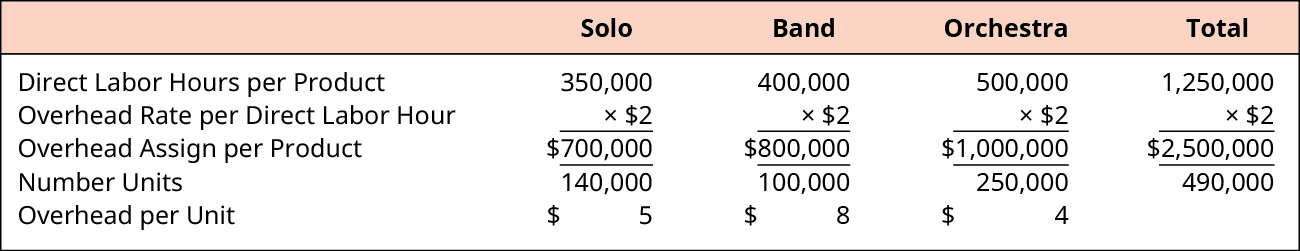

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

The Absorption Costing Method In Management Accounting Magnimetrics

Price Comparisn Between Puregold And Their Competitors Grocery Price Grocery Items Grocery Price List

How To Calculate Fixed Cost Per Unit Double Entry Bookkeeping

Building Costs Per Square Metre In South Africa For New Residential Commercial And Industrial Properties Estimation Qs

Sports Are Good But Be Aware Of The Injuries Debbie Rodrigues Health Matters Awareness Physical Activities

News Greenpeace Australia Pacific Ocean Sustainability Sustainable Fishing Ocean

How To Calculate Growth Rate 7 Steps With Pictures Wikihow

How To Calculate Growth Rate 7 Steps With Pictures Wikihow

Manage Buying And Selling Prices Tally Erp 9

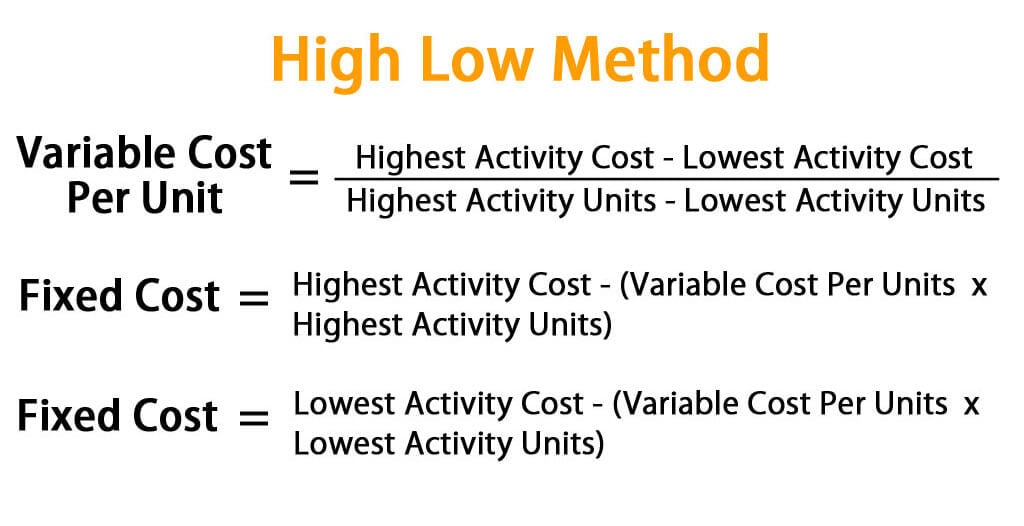

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Plumbing Tips Plumbing Knowledge Plumbing 101 Book Plumbing World Tv Ad Toto Plumbing Supply Store Green Plumbing Chemical Free Cleaning Helpful Hints

How To Manage Buying And Selling Prices In Tallyprime Tallyhelp