An amended return cannot be filed electronically. The workaround is to delete the 300 in the error check.

Anyone with income of 72000 or less can file their federal tax return electronically for free through the IRS.

How to fix form 1040. However starting with the 2019 tax year taxpayers age 65 and up may be able to file using the new Form 1040-SR. Paper filing is still an option for Form 1040-X. Before 2019 there were shorter versions of Form 1040 for filers with simpler returns.

Individual Income Tax Return. If your total taxable interest is greater than 1500 you cant use the form 1040EZ and must use either Form 1040 or 1040A. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

Recalculate the totals on Form 1040 making sure that you include all changes. An amended return cannot be e-filed. How can I fix the error on line 10b of form 1040 when I have itemized.

Indicate the tax year of the return youre amending at the top of the first page of Form 1040-X. Form 1040X To amend your tax return use Form 1040X available on the IRS website. Include your personal information and contact details.

Mail each form in a. You must file it on paper through the mail. On Line 24 enter any penalties owed if applicable.

Its called appropriately enough Amount You Owe On Line 23 subtract Line 19 from Line 16 to get the amount you owe. Remember that the standard deduction for all years can be increased for the age andor blindness of the taxpayers. Go back to Schedule 1 and review adjustments to income to see if anything changed as a result of your changes to Schedule C.

These were Form 1040EZ and 1040A but they no longer exist. Many people will only need to use Form 1040 and none of the new numbered schedules. The IRS automatically makes those corrections.

Put this new total from Schedule 1 on Form 1040 line 7a. Electronic Filing Now Available for Form 1040-X. Before you start filling out Form 1040X make sure you print your original return so that youll have it to refer to.

If you are using the standard deduction enter the amount for your filing status for the year you are amending. Re-add the adjustments and get a total on Line 22. You can correct your Social Security number at the top of the form next to your name or the number for a dependent on line 29.

The IRS now requires most taxpayers to use Form 1040. Use the clues to complete the pertinent fields. Boxes for each year are clearly provided.

On the website containing the blank choose Start Now and move for the editor. You can use form 1040X. To fix the problem you need to file an amended tax return.

This is a generic form and can be used for any tax year but youll have to submit separate Forms 1040-X for each year if you want to revise several tax returns. Individual Income Tax Return downloads as a pdf. If your total taxable interest is 1500 or less enter that amount on line 2.

Make sure that you choose to enter suitable information and numbers in suitable fields. Form 1040-X can now be e-filed and is available through some companies. Youll do this by amending your previously filed tax return with a federal form 1040X Amended US.

If you are amending Form 1040EZ see Form 1040EZ FilersLines 2 and 4a amended returns for years prior to 2018 only later for the amount to enter. Thats what the final section of Form 1040 is for. The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040-SR instructions can also help determine if you are eligible for the credit and how much you can claim.

To do so you must have e-filed your original 2019 or 2020 return. You will use the redesigned Form 1040 which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Then go back to Deductions Credits and enter the contribution there in the Donations to Charity topic.

Use Form 1040X Amended US. Put this new total on Form 1040 line 8a. Form 1040X is filed to correct previously filed Forms 1040 1040A or 1040EZ.

If you have no taxable interest enter 0 zero on line 2. For more details see our August 2020 news release on this topic. File a separate Form 1040X for each year you are amending.

You must use snail mail. However if your return is more complicated for example you claim certain deductions or credits or owe additional taxes you will need to complete one or more of. Generally you do not need to file an amended return to correct math errors.

The Form 1040 is the basic form.

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Irs Releases Draft Form 1040 Here S What S New For 2020 Income Tax Return Irs Forms Tax Return

9 Common Us Tax Forms And Their Purpose Infographic Tax Forms Income Tax Preparation Us Tax

What Is The 2018 Form 1040 Tax Forms Income Tax Tax

Form 1040 X Amended Returns Can Now Be E Filed Cpa Practice Advisor

Step By Step Instructions To Fill Out Schedule C For 2020

Form 10 Reconciliation Worksheet 10 Exciting Parts Of Attending Form 10 Reconciliation Works Irs Tax Forms Irs Taxes Tax Forms

It S Form 1040 In Excel Need I Say More Going Concern

Fillable Form 1040 Individual Income Tax Return Income Tax Tax Return Income Tax Return

See The New Irs 1040 Tax Form For 2020 2021 Tax Filing Tax Forms Irs Irs 1040

2019 Form 1040 Client Phone And Email Under Si Intuit Accountants Community

How To Fill Out Irs Form 1040 Irs Forms Tax Forms Tax Refund

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

How Do I Get A Tax Transcript From The Irs Amy Northard Cpa The Accountant For Creatives Irs Irs Taxes Small Business Tax

Irs Form 1040 From 2008 Born In Equity

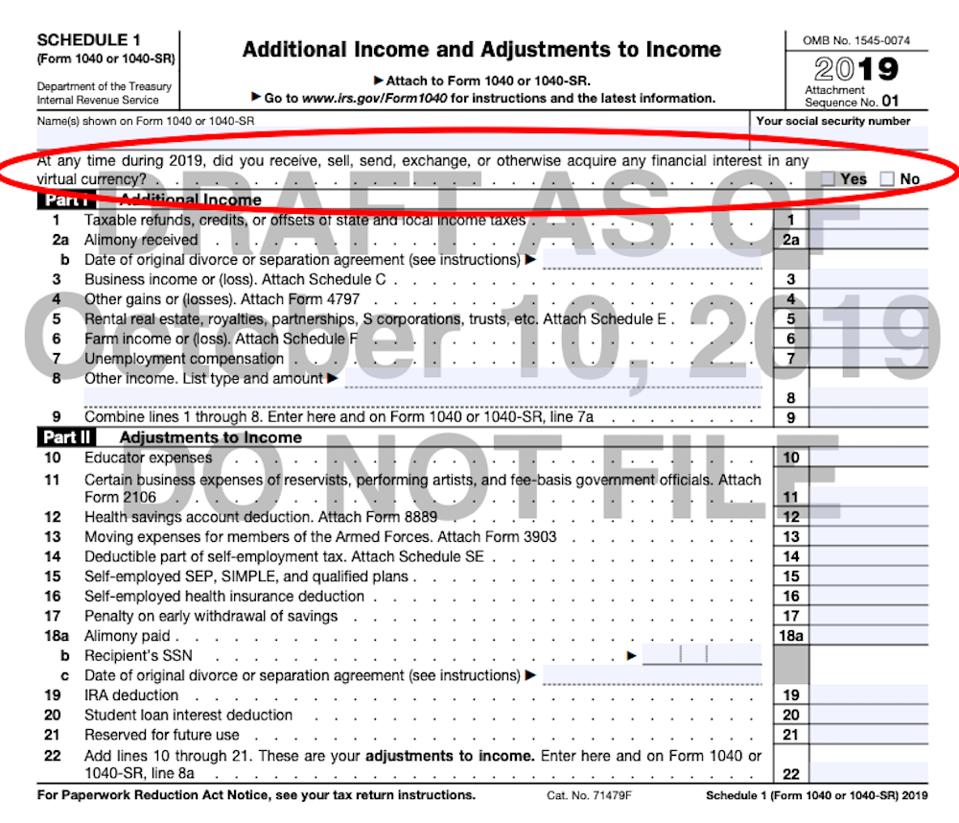

There S A New Question On Your 1040 As Irs Gets Serious About Cryptocurrency